You would only be able to claim a capital cost of 30000 plus appropriate taxes on that 30000. 4 over 25 years for most industrial buildings.

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

- cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc.

. It is granted to a person who owns depreciable assets and use those assets in. Vans trucks and lorries are generally considered. Standard rates With effect from YA 2000 cyb capital allowances are re-categorised into three classes and the rates of.

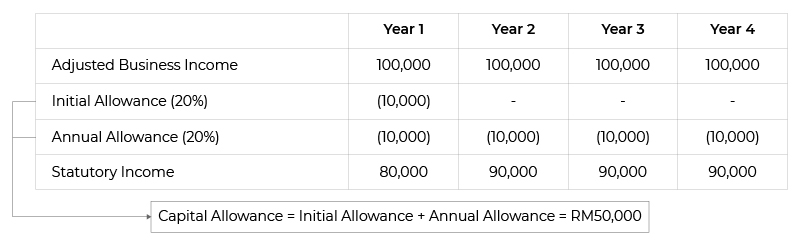

Q-plated and RU-plated cars unless. Work out your capital allowances at the main rate 18 or the special rate 6. The initial allowance of 20 and annual allowance of 20 is based on the notional cost ceiling of RM50000 not the actual cost of the car up to a maximum capital allowance of RM50000.

COMPUTATION OF CAPITAL ALLOWANCES Public Ruling No. Claim capital allowances so your business pays less tax when you buy assets - equipment fixtures business cars plant and machinery annual investment allowance first year allowances. 1140 Woodbridge Road East Hazelwood Avenue.

Edison Motor Vehicle Commn. 27 August 2015 _____ Page 4 of 22 52 Vehicle a QE for a vehicle licensed for commercial. The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business.

The annual allowance for motor vehicles other than taxis and short term hire vehicles see below is 125 on a straight line basis subject to a maximum qualifying cost of 24000 for. Commercial vehicle van lorry and bus What is eligible for capital allowance. You can claim Annual Investment Allowance AIA on the latter vehicles listed above because they are not considered cars.

Motor Vehicle Drivers Lic. Vehicle License Registration. Capital Allowance Claim for Motor Vehicles.

Qualifying expenditure QE QE includes. The rate for Initial Allowance and Annual Allowance is 20 respectively. A company can claim.

Title Tags Inc. 2110 Adam Clayton Powell Jr Blvd. Ad Accurate IRS-compliant non-taxable vehicle reimbursements for each employee.

A company can claim capital allowances at a rate of. Vehicle License Registration 609 252-6500. The amount to claim is entered on Form T2125 in column 3 of Area B.

B6 CAPITAL ALLOWANCES A1. Rates and Fees Refunds TCC TRN FATCA GCT on Government Purchases Direct Banking Direct Funds Transfer. Capital allowance is only applicable to business activity and not for individual.

S-plated cars and business cars eg. The New York State Department of Motor Vehicles also known as NYDMV is a state-level government agency that. Transform your vehicle reimbursement program with CarData - See How.

Transform your vehicle reimbursement program with CarData - See How. 125 over eight years for plant and machinery. 455 Hoes Lane Piscataway NJ 08854 Phone.

Passenger private vehicle. This is a standardised deductible allowance in place of Financial Accounting depreciation. Ad Accurate IRS-compliant non-taxable vehicle reimbursements for each employee.

If you use an item outside your business and youre a sole trader or partner put it in a separate pool. Motor vehicle will be classified into 2 categories-Commercial car such as van lorry and bus. Capital allowances cannot be claimed on the costs of private cars eg.

62015 Date Of Publication. New York NY 10027. Motor vehicle for Capital Allowance is classified into 2 categories.

Certificate Of Origin For A Vehicle Template Beautiful Motor Vehicle Certificate Of Payment Of Sales Or Use Tax

Compare Car Iisurance Compare Auto Lease Vs Purchase

2017 Use Of A Motor Vehicle Edited Youtube

Automobile And Motor Vehicle Allowances Canada Ca

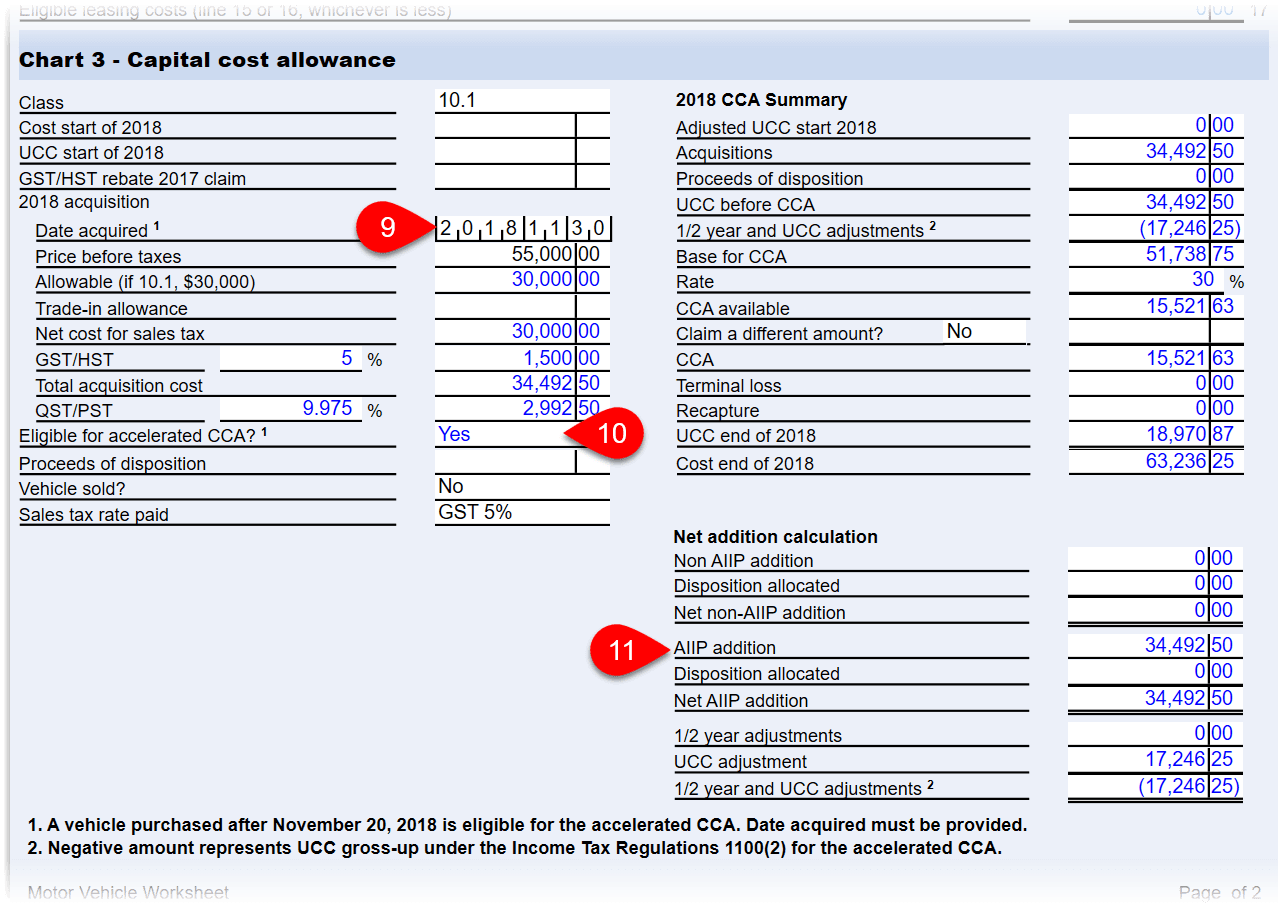

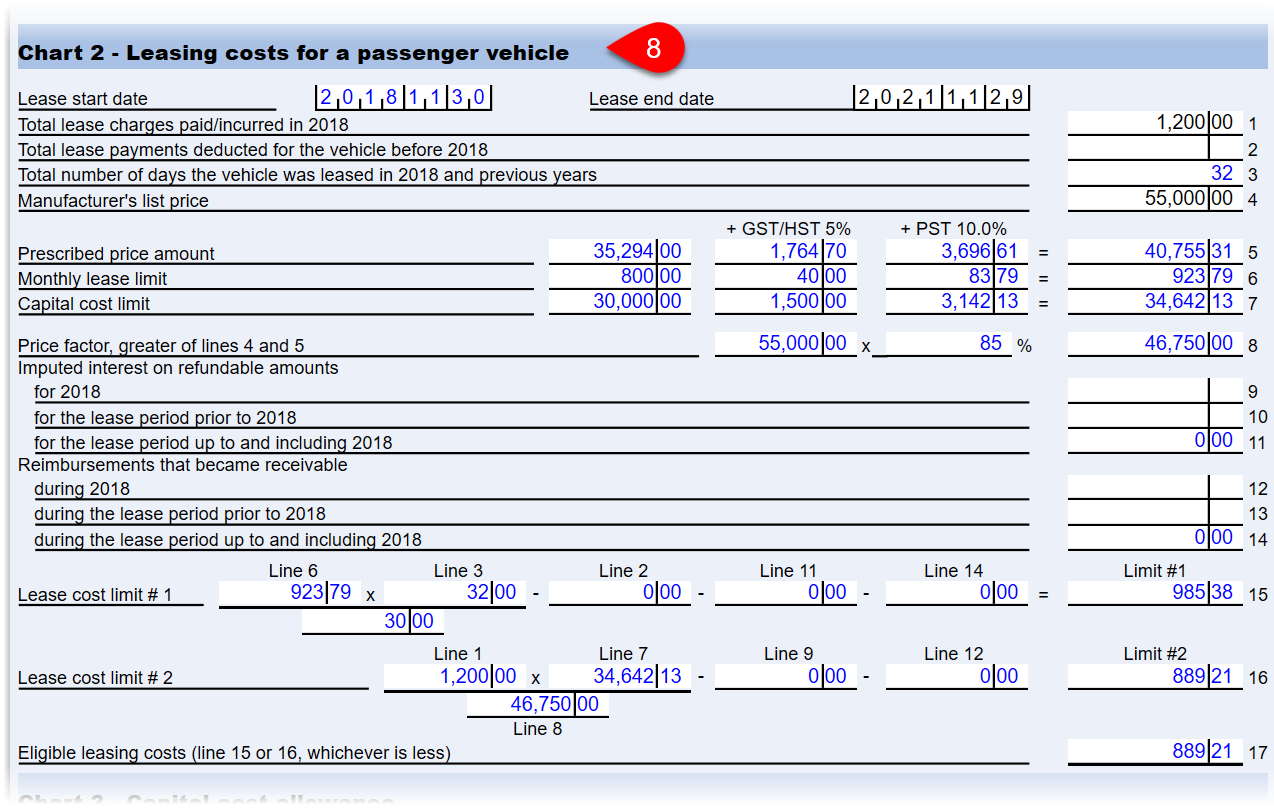

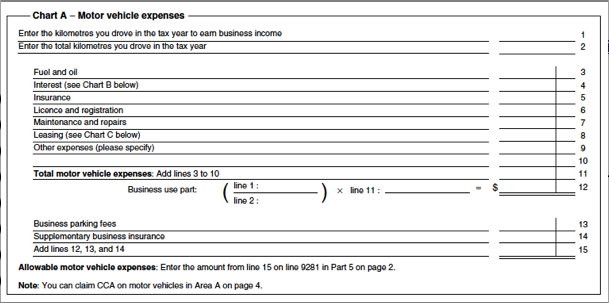

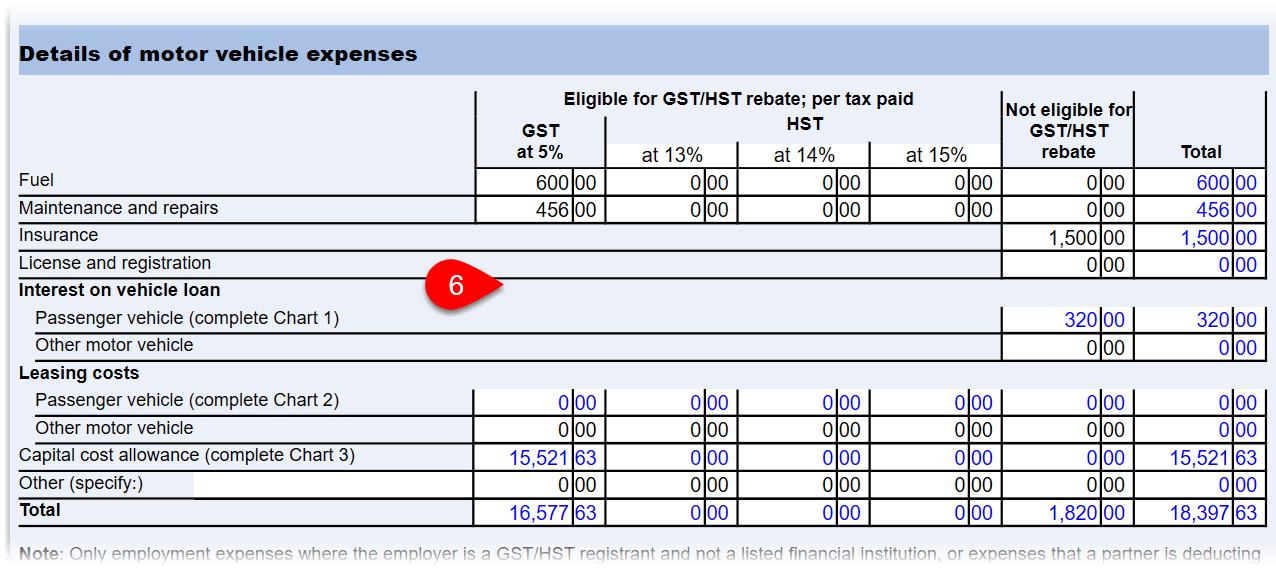

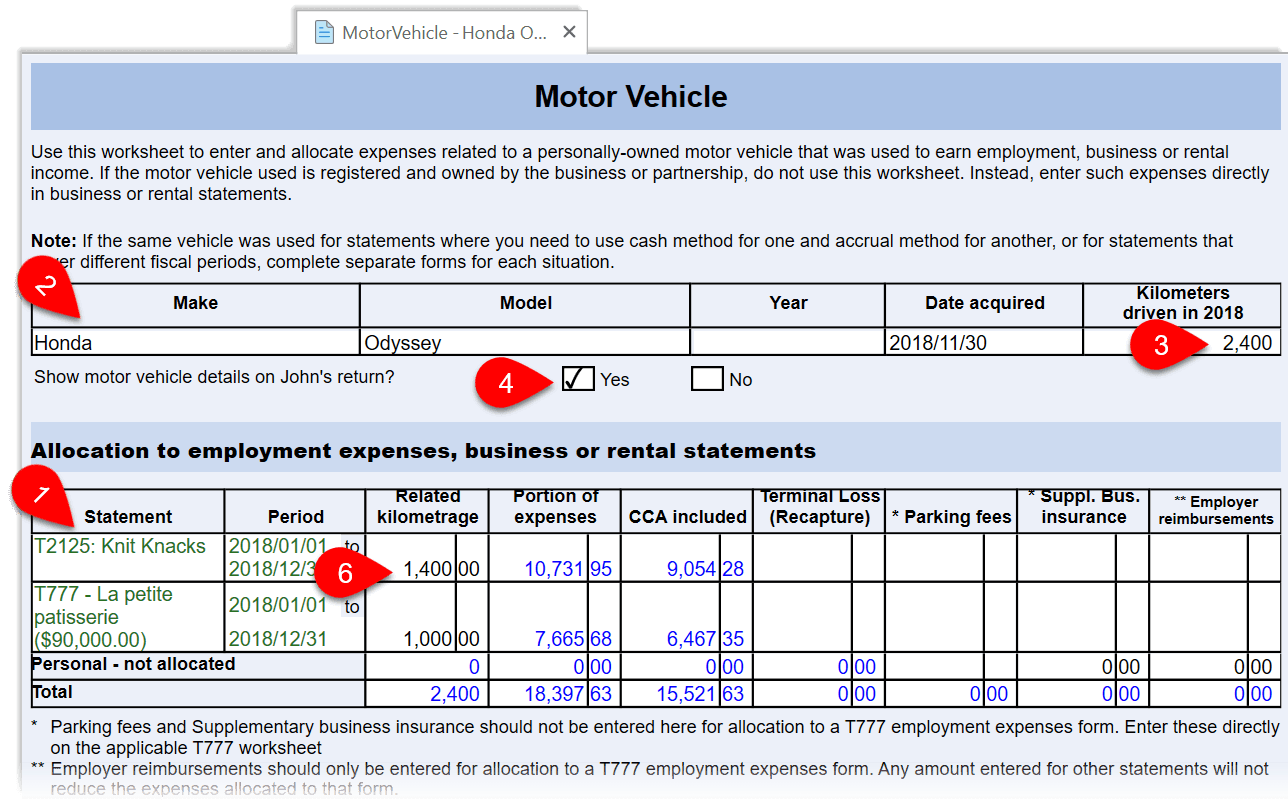

Motor Vehicle Expenses Taxcycle

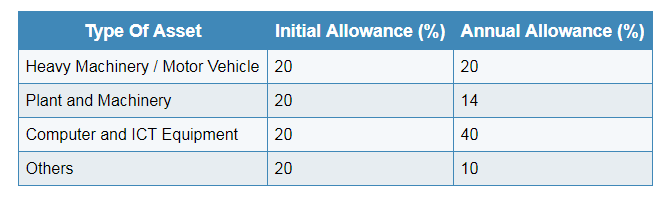

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Motor Vehicle Expenses Taxcycle

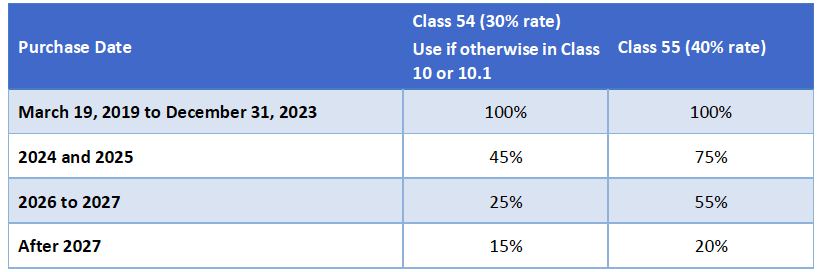

Knowledge Bureau World Class Financial Education

Business Vehicle Expenses Focus On Tax

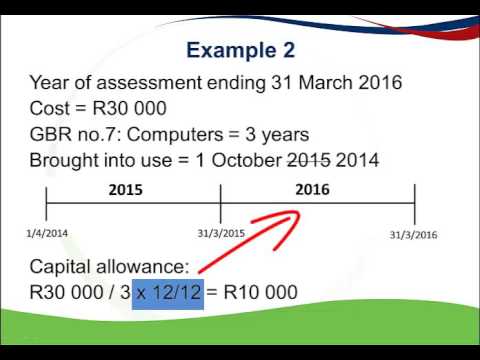

2016 Capital Allowances Sec 11 E General Wear And Tear Youtube

1975 Leyland Australia Jaguar Xj6 Xj V12 Aussie Original Magazine Advertisement Jaguar Car Jaguar Jaguar Xj12

Fixed Asset Trade In Double Entry Bookkeeping

Motor Vehicle Expenses Taxcycle

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Motor Vehicle Expenses Taxcycle

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Claiming Cca On Your Vehicle Turbotax Support Canada Youtube

Capital Allowance Calculation Malaysia With Examples Sql Account

Depreciation Definition N Hkssap Defines Depreciation As The